June 5, 2020

This week saw 110,000 Americans dead from the last three months of COVID-19, 21.5 million on continued unemployment, and protests and riots in the streets of the United States. 2020 may be the most turbulent year in memory for most Americans and it is only halfway over. It is times like these, that we are thankful for our Vermont community.

We love our community not because it is perfect; we still have work to do. We love our community because we are confident there is no dearth of leadership, compassion, humility, or motivation in these Green Mountains we call home to make meaningful change. As we shared earlier this week, the Chamber’s ultimate vision is economic opportunity for all Vermonters. This cannot be achieved without radical changes to racialized systems that oppress Black people and hold us back from moving forward as a united people. We are committed to learning and improving throughout the life of this organization. We will always work to do better and we hope you will join us in learning the lessons 2020 has to teach us and working to be better for it.

In this week’s update:

- Governor’s next turn of the spigot allows limited travel, outdoor dining, some lodging

- An overview of how and where money is being allocated

- PPP Flexibility Act passes

- Restaurant Webinar and Resources

- Shuttered lodging properties see a ban on tiny toiletries

- Burlington City Council considers property transfer and income tax

- The Laundry List

Governor Further Turns the Spigot

Today Governor Scott announced that the latest modeling allows for a further lifting of restrictions, despite a small cluster of cases in Winooski. The Governor announced indoor dining may resume at 25% capacity or 10 total customers and staff combined, whichever is greater beginning Monday under only slightly modified conditions to the existing guidance for restaurants.

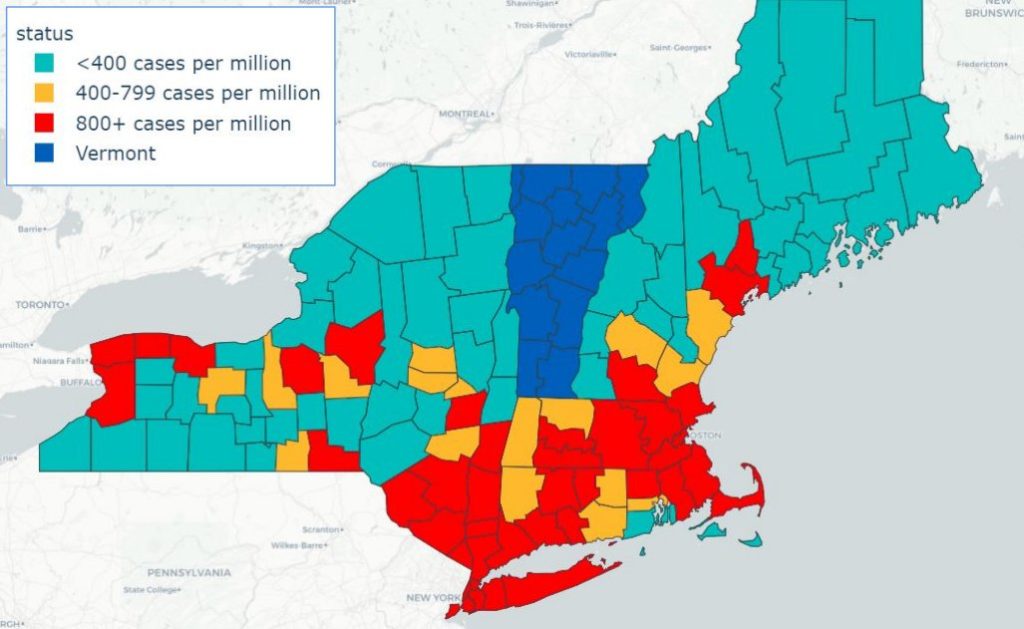

Quarantine restrictions were amended for out-of-state visitors from “Step 1” counties in New York or northern New England with 400 or fewer cases per million. People from what is currently about 55 counties may visit Vermont without quarantining for 14 days. Travelers are required to travel in their personal vehicles straight to their destination. Travelers from areas other than New England and New York will still have to follow quarantine rules for the foreseeable future. These restrictions are also reciprocal, meaning that if you visit the 55 counties meeting those requirements, you will not need to quarantine upon returning. Travelers are required to sign up for daily symptom check with Sara Alert upon arrival to Vermont to get two weeks of daily reminders to check for common symptoms of COVID-19.

On the heels of this, lodging establishments can reopen to 50% capacity on Monday under this difficult, new county-by-county patchwork of travel restrictions. The restrictions aim to welcome guests from counties with similar COVID-19 case rates as Vermont.

All of these updates can be found in ACCD’s frequently updated Be Smart, Be Safe memo.

State Budgeting, Economic Relief, and CRF Spending Takes Shape – For Better or Worse

Today the House passed a partially unfinished budget bill that would fund state government for the first three months of the next fiscal year, which begins on July 1st, at about the same level that it did in the same quarter of the last fiscal year. The bill also appropriates Coronavirus Relief Fund (CRF) dollars to a number of state entities.

The Scott Administration had proposed a 2% reduction in the first quarter budget that would amount to an 8% cut if it continued throughout the year. The administration also put into place a hiring freeze on non-essential positions and will prevent any non-unionized state employees from receiving a pay increase or bonus in the next fiscal year. Vermont State Employee union members will still see a one-time $1,400 lump sum payment at the beginning of the upcoming fiscal year as well as raises of 2.25% in FY 22 as their contract currently stands.

Senate President Tim Ashe and House Speaker Mitzi Johnson plan to move forward with immediate economic relief in the form of a scaled-back version of the grant portion of the Governor’s relief package. As we’ve outlined the last two weeks, the Governor envisioned a two-part economic relief package with the first part consisting of:

- $150 million in grants to businesses that pay trust taxes to the state;

- $80 million in loans with a grant advance;

- $20 million in small business grants;

- $50 million in housing assistance;

- $5 million in technical assistance, and;

- $5 million in marketing funds.

On Thursday, Speaker Johnson sent a memo to committee chairs outlining how they are to proceed with their committees’ requests to the Appropriations Committee for a portion of the $1.25 billion in CARES Act CRF dollars. The legislature, Joint Fiscal Committee, and Administration have already spent about $275 million allocated during the FY 20 budget adjustment. The Speaker envisions appropriating $575 million of the CRF dollars during the initial budget that covers the first quarter of FY 21. Of that $575 million dollars, a set amount is allocated to each chair to let them get to work on “first-tier priorities.” The memo states, “there are no promises,” as leadership might need to “rebalance committee targets.”

That leaves $400 million in CRF dollars, which the speaker intends to hold in reserve and allocate when the legislature meets again in August to address the last nine months of the FY 21 budget. Of this amount, committees were allocated a smaller amount for “second-tier priorities,” however, $400 million is close to the amount the state needs to cover the tax revenue losses in the coming fiscal year and one could infer that if Congress or the Treasury changes the rules governing the CRF between now and August, to allow the state to backfill lost revenues, the speaker might rebalance priorities. This would allow the legislature to forgo the need to make any cuts in state government, a rift growing between the Governor and legislature we outlined above. This is a risky move, and may just be delaying the inevitable, as the state’s revenues are not going to rebound until FY 24 or later. Either way, leadership risks businesses going under which would mean they will receive less tax revenue.

Last week the U.S. Treasury issued new guidance on the use of CRF dollars that squashed the hopes of many that hazard pay could be sent from the state to essential workers, and created new challenges for broadband buildout. The guidance also outlined that any loan dollars would need to be returned to the Treasury after they are paid back. Also playing into the calculations of House and Senate leadership must be the potential funding that could come to the state if the beleaguered HEROES Act is passed by the U.S. Senate. This bill, which is in relative deadlock, would bring an additional $1.32 billion to Vermont this fiscal year and 1.43 billion in the next fiscal year, as well as almost a half-billion to be distributed among municipalities this fiscal year and almost a quarter-billion in the next – if it passes looking like what the House passed.

Speaker Johnson told reporters that the initial round of relief for businesses would likely fall into the $60 million-$90 million range in the coming weeks. The House Committee on Commerce and Economic Development, which is handling this relief, was told in a memo from the Speaker that they were allowed to spend $150 million from the CRF in this budget, with the intention to have another $30 million to appropriate when they return in August, presumably if the rules governing CRF don’t change to allow to backfill for lost state revenues.

As of this afternoon, the Committee contemplated appropriating $70 million for grants to businesses that can show a 75% loss in revenue via their filings of trust taxes, rooms and meals, or sales tax. If an applicant can demonstrate that need, they would be eligible for a grant equivalent to 5 percent of the business’s average annual sales subject to sales and use, and to rooms and meals taxes, from calendar years 2018 and 2019 through myvtax. The thought, it seems, is that the program could go through the first tranche of funding and then either be backfilled with additional funding at those parameters, or the demonstrated loss of revenue could be dropped, possibly to 60%.

The Committee might also explore using the Vermont Economic Development Authority and the Regional Development Corporations to cover those businesses that have seen the same level of loss, yet don’t file trust taxes. The Committee does not envision previous access to federal aid factoring into the need calculations. The committee’s most recent draft bill can be found here.

Meanwhile, the Senate Committee on Economic Development, Housing, and General Affairs passed their own version of a response to the Governor’s proposal. Both versions will converge next week and the collective goal is to get some type of package out by next Friday. From the House perspective, it will need to be a $70 million tranche and that will leave $80 million in the next week to allocate to technical assistance, marketing, and other assistance.

LCC conveyed our concerns this week through multiple channels of communication. The economic recovery plan proposed by the Governor will not solve the lasting damage to these businesses and to our economy. However, if the Legislature does not act quickly to provide businesses with the full financial assistance envisioned in his plan, we risk these businesses shutting their doors forever. We risk our economic recovery, we risk the employment of thousands of Vermonters who have lost their jobs, and we risk larger state budget shortfalls that last longer.

As we said last week, in addition to advocating for relief, you can make sure you are ready to capitalize on it in the event the legislature passes it by making sure you have a myVTax account and are up to date on filings. There is a ubiquitous agreement that this will be the preferred method of grant delivery. Also, failure to pay taxes won’t disqualify you, however, all indicators point to an applicant needing to have filings up to date and be on some manner of payment plan. The discussion has also drifted into allowing of this money recipients to leverage loans, so you may want to connect with your financial institution to understand what your options are.

PPP Flexibility Act Passes the Senate, Signed by President

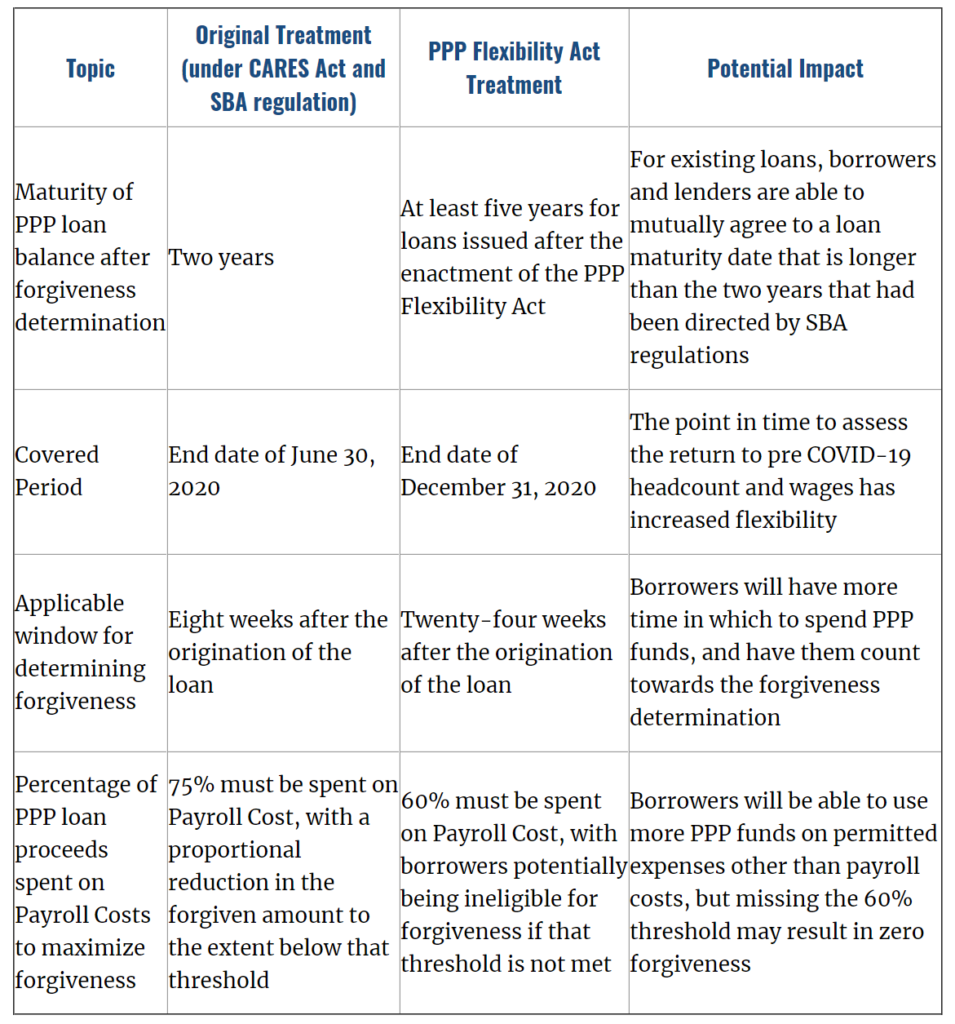

Wednesday evening, the U.S. Senate passed the long advocated for PPP Flexibility Act by unanimous consent and the President signed it hours ago. While this is all good news, it will need to go through the rulemaking process and we’ve all seen how that can ruin promising legislation during this crisis. We’d suggest that if you don’t have a PPP you consider getting together what you need for an application now. If you already have a PPP, contact your lending institution to understand what it means for you specifically.

The bill does the following:

Source: National Law Review

The bill also removes the exception that prevented PPP borrowers from using the deferral of payroll taxes made possible under CARES.

The SBA Vermont District Office is hosting a free daily webinar from 9:00-10:00AM Monday through Friday to discuss Paycheck Protection Program forgiveness and other changes. To register for the webinars, go here.

Restaurant Resources

If you are a restaurant, you should make a point of attending SCORE Vermont’s free webinar for restaurants on Tuesday, June 9th at 10:00 am. The webinar, “Restaurant Survival Strategies Post-COVID,” will provide guidance on complying with health and safety requirements and financial models for future breakeven sales levels and customer counts.

LCC asked the legislature, as you should too, to put into statute the temporary changes that allowed the delivery and to-go distribution of alcohol, as we realize this will need to be a component of the business model for Vermont businesses for some time to come.

Sign the petition.

In these uncertain times, Vermont businesses need as much certainty as we can provide. The new flexibility from Directive 4 to serve alcohol by curbside and delivery methods has provided a needed source of revenue for our struggling small Vermont businesses. As these businesses look forward and plan for the coming months which will be filled with great uncertainty, it would be helpful to know that they can depend on the flexibility afforded to businesses under the Governor’s Executive Order and incorporate it into their business model.

Also, as we shared last week, ACCD worked with VTrans to provide guidance on the use of public rights of way for restaurants and retail businesses. The guidance lays out considerations and steps to ensure social distancing to enable a wider restart of retail operations and restaurants, in a way that does not increase the risk of auto-related injuries, addresses pedestrian safety and accessibility, and shares items towns and businesses should consider when using the street during these times.

Lodging Restrictions and Ban on Single-Use Toiletries

Many lodging properties will be discouraged by an announcement to see a more limited re-opening than what they expected on June 15th. We understand that this will require many lodging establishments to cancel reservations that they had previously made under the supposition that they could arrive on June 16th. LCC is committed to working with the administration to find more options that allow visitors to our state while preserving public health.

In a totally unrelated note, however, one that for some equates to adding “insult to injury,” the Senate Finance Committee passed S.227, a bill that bans the furnishing of guest rooms with small toiletry bottles (which as defined would include hand sanitizer) by 2023. LCC members, some of whom were open to the changes before COVID-19, had reached out to convey their dismay, as the move to bulk shampoo and soap dispensers in rooms will cause a financial burden to properties currently shut down by the pandemic and introduce new health and safety concerns to be navigated at this difficult time. These concerns were brushed off by one member of the committee who indicated that those with concerns did not understand the bill.

Members of the Finance Committee were uneasy about the optics and message they were sending by voting for the bill, however, they felt that because it has an effective date three years in the future that, despite the current pandemic, they still want to make progress on their goals to eliminate single-use plastic. You can watch the final conversation before the vote here.

Burlington City Council Proposes Tax Hikes on Some Residents

This week, the Burlington City Council considered a resolution that included an income tax on residents who earn more than $125,000 a year, or couples making more than $200,000 a year, as well as a property transfer tax on homes that sell for $500,000 or more. The proposal was postponed on Monday night, however, it will likely be back.

Such a proposal would require a city charter change which first involves the resolutions being referred to a Charter Change Committee and public hearings. The proposal would then need to go to a city-wide vote. The earliest this could happen under current circumstances would be on the November 3rd election ballot, which would require the charter change committee to be done with the proposal by August 10th. If they were not able to do that, the next earliest date would be Town Meeting Day in 2021. If passed at either of these times, the change would then need to go to the legislature for approval.

The Laundry List

The Laundry List

- LCC has been working with businesses in the event sector to facilitate the creation of a reopening plan. If you are interested in participating or weighing in, contact [email protected].

- Total new and continuing Vermont unemployment claims this week are 47,781, a decrease of 4,056 from the previous week, and Vermont still has $410 million in its unemployment trust fund.

- Commissioner of the Department of Children and Families, long-time public servant, and all-around great human being Ken Schatz announced his retirement this week. Current Deputy Commissioner, Sean Brown will replace him. We’ll miss Ken’s leadership.

- A reminder that restart plan templates are now available for construction; golf courses; gyms and fitness centers; manufacturing, distribution and warehousing; real estate sales and leasing; restaurants; and retail establishments. These plans can help businesses establish best practices as they reopen and train employees on safety precautions and protocols.

- ACCD still wants to hear from all Vermont businesses impacted by the response to the COVID-19 virus. Please share these impacts via the ACCD Business Impact Form, which will help us assess the full impact as we work toward solutions.

- Burlington has launched a “Making Space” program for restaurants to easily expand their footprint to offer outdoor seating and/or vending. Learn more and apply here.

- Read last week’s newsletter here.

Concerned or need to learn more about anything in this newsletter? Email our team at [email protected].

We look forward to working with you.

Sincerely,

The Lake Champlain Chamber Advocacy Team